盖德莱恩斯

Guidelines

Short on time? Here are the highlights:

Educators in the leading destinations of Australia, Canada, the UK, and the US are adopting a “post-pandemic” mindset in their approach to recruiting and they are facing a different competitive landscape

Overarching goals are sectoral recovery and market diversification

As a result of their individual governments’ policy approaches during the pandemic as well as government policies moving out of the pandemic, each of the leading destinations has a different recovery trajectory

So far, the UK appears to be leading in terms of both overall growth as well as diversification, and it is seeing demand spike significantly from the key markets of Nigeria and India

In the first months of 2022, it is fair to say that educators in the top four English-speaking destinations for international students – the US, the UK, Canada, and Australia – are recruiting according to a “post-pandemic” mindset, where the assumptions are that:

Travel restrictions are no longer expected to hamper international student mobility;

Demand for study abroad is on the rise;

International students are currently deciding where they want to study abroad;

Competitor destinations are actively recruiting in priority markets.

Educators in each leading destination are aware that the competitive context for their recruiting activities has changed dramatically from what it was before the pandemic. The flow of students from China is slowing. Diversification is a major priority in all four destinations. Students have become increasingly interested in affordability, immigration opportunities, and career outcomes. One of Canada’s most powerful competitive advantages – generous post-study work rights and immigration opportunities – is under some pressure, given that the UK has reinstated post-study work rights; the US is extending OPT allowances for STEM students; and Australia is also becoming more generous with work rights as it attempts to recover enrolment declines after nearly two years of border closures.

All four destinations remain invested in their top student markets of China and India. But these markets are increasingly unpredictable and the race is on to develop other emerging markets. At this point in time, we thought we’d take a look at enrolment and visa trends in Australia, Canada, the UK, and the US as they relate to established as well as key emerging markets.

Diversification: How far along are the four destinations?

Australia’s International Marketing Strategy 2021–2030 includes a couple of fascinating comparison graphics illustrating the extent to which the top four destinations were diversified across student markets in 2020.

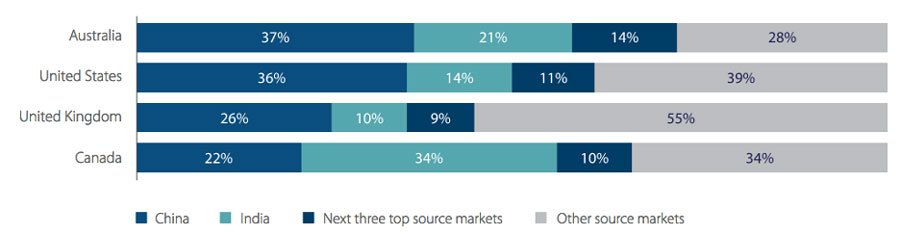

The first chart below tells us that in 2020:

Australia and the US were more reliant on China than was the UK;

Canada was much more heavily reliant on India than were other destinations;

Australia and Canada drew a heavier share of enrolments from their top five source markets than did the US and especially the UK;

The UK hosted a much wider set of nationalities than the US, Canada, and Australia (in part because of its proximity to the many countries of Europe and established mobility patterns from Europe to the UK).

Top source markets for Australia, US, UK, and Canada, 2020. Source: Australia’s International Marketing Strategy 2021–2030

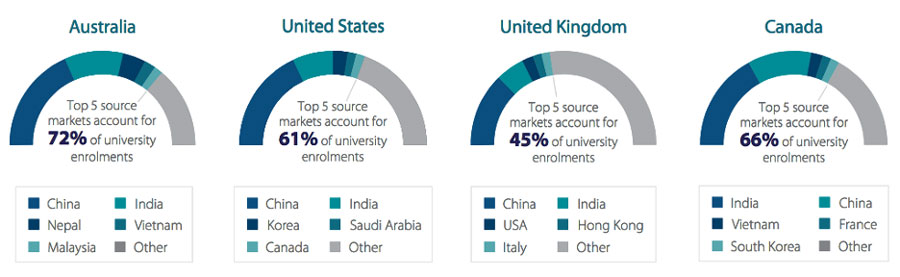

The next chart breaks down the top five source markets for universities in each destination in 2020:

Australia: China, India, Nepal, Vietnam, Malaysia

US: China, India, South Korea, Saudi Arabia, Canada

UK: China, India, US, Hong Kong, Italy

Canada: India, China, Vietnam, France, South Korea

Diversification across top four destinations for study abroad, 2020. Source: Australia’s International Marketing Strategy 2021–2030